Unlocking Performance: Just How Independent Adjuster Firms Streamline Claims Handling

Unlocking Performance: Just How Independent Adjuster Firms Streamline Claims Handling

Blog Article

Professional Overview to Becoming an Independent Insurer in the Insurance Coverage Industry

Embarking on a profession as an independent adjuster within the insurance market needs a meticulous understanding of the elaborate functions of this specific field. Beyond the surface-level obligations generally related to insurance, the role of an insurance adjuster requires a special collection of skills and qualifications to browse the intricacies of examining and figuring out insurance claims. From refining crucial abilities to getting the necessary licensure, the journey to ending up being an effective independent adjuster is complex and calls for a strategic technique. Ambitious experts need to look into the subtleties of this career, from constructing a durable profile to establishing a solid network within the sector.

Comprehending the Independent Insurer Duty

Recognizing the duty of an independent adjuster involves thoroughly reviewing insurance coverage cases to determine exact negotiations. Independent insurers play an essential role in the insurance coverage industry by examining cases, assessing policy information, examining residential property damages, and evaluating the degree of insurance coverage. These experts act as objective 3rd parties, dealing with behalf of insurance provider to make sure prompt and reasonable claim resolutions.

In order to accurately analyze cases, independent adjusters should possess a strong focus to information, analytical abilities, and a deep understanding of insurance policies and regulations. They should thoroughly examine paperwork, collect proof, and meeting relevant celebrations to make informed choices about claim settlements. Independent insurers also require superb interaction skills to successfully negotiate with plaintiffs, insurer, and other stakeholders associated with the claims procedure.

Crucial Skills and Certifications

Possessing a diverse set of certifications and abilities is important for people aiming to stand out as independent insurers in the insurance coverage industry. Independent insurance adjusters must possess superb communication skills to effectively engage with customers, insurance business, and various other specialists in the area.

Additionally, having a solid understanding of insurance coverage legislations, procedures, and principles is vital for independent insurance adjusters to navigate complicated cases procedures effectively. independent adjuster firms. Efficiency in computer system software application and technology is increasingly important for taking care of insurance claims efficiently and preserving accurate documents

A history in money, organization, or a relevant field can provide a strong foundation for striving independent insurance adjusters. Acquiring appropriate accreditations, such as the Accredited Claims Insurance Adjuster (ACA) classification, can likewise improve credibility and demonstrate a commitment to professional advancement in the insurance policy industry. By sharpening these vital skills and credentials, individuals can position themselves for success as independent adjusters.

Browsing Licensing and Accreditation

Having acquired the necessary abilities and qualifications required for success as an independent insurer in the insurance coverage market, the following crucial step includes browsing the details of licensing and qualification demands. In the United States, independent adjusters are usually required to get a permit in each state where they prepare to work.

Additionally, getting expert qualifications can enhance an independent insurer's reputation and bankability. Organizations such as the National Organization of Independent Insurance Adjusters (NAIIA) and the American Institute for Chartered Property Casualty Underwriters (AICPCU) supply certification programs that cover different elements of the readjusting procedure. These certifications demonstrate a commitment to professionalism and continuous education within the field, which can establish insurers apart in a competitive market (independent adjuster firms). By recognizing and satisfying the licensing and accreditation demands, independent insurers can place themselves for success in the insurance policy industry.

Structure Your Adjusting Profile

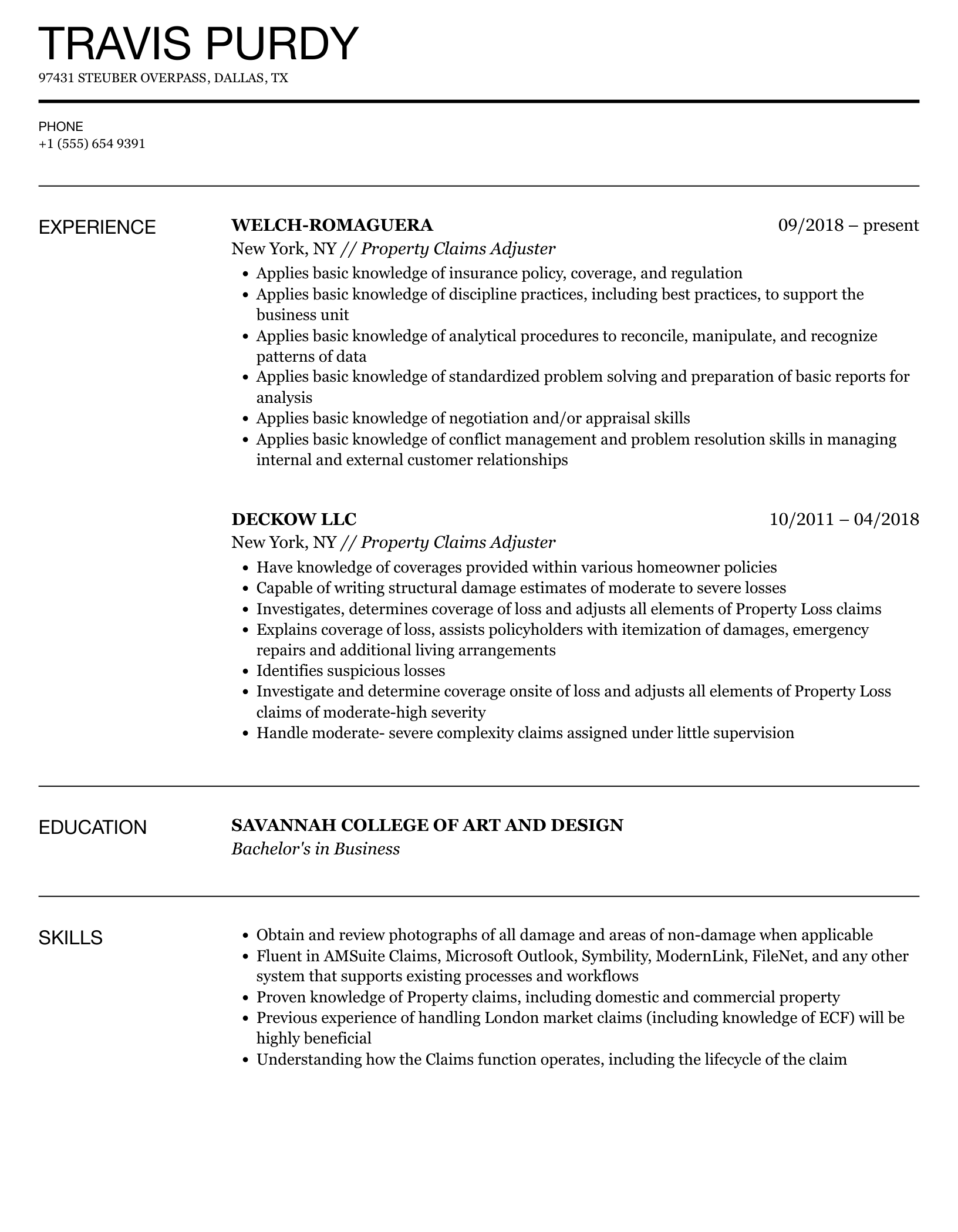

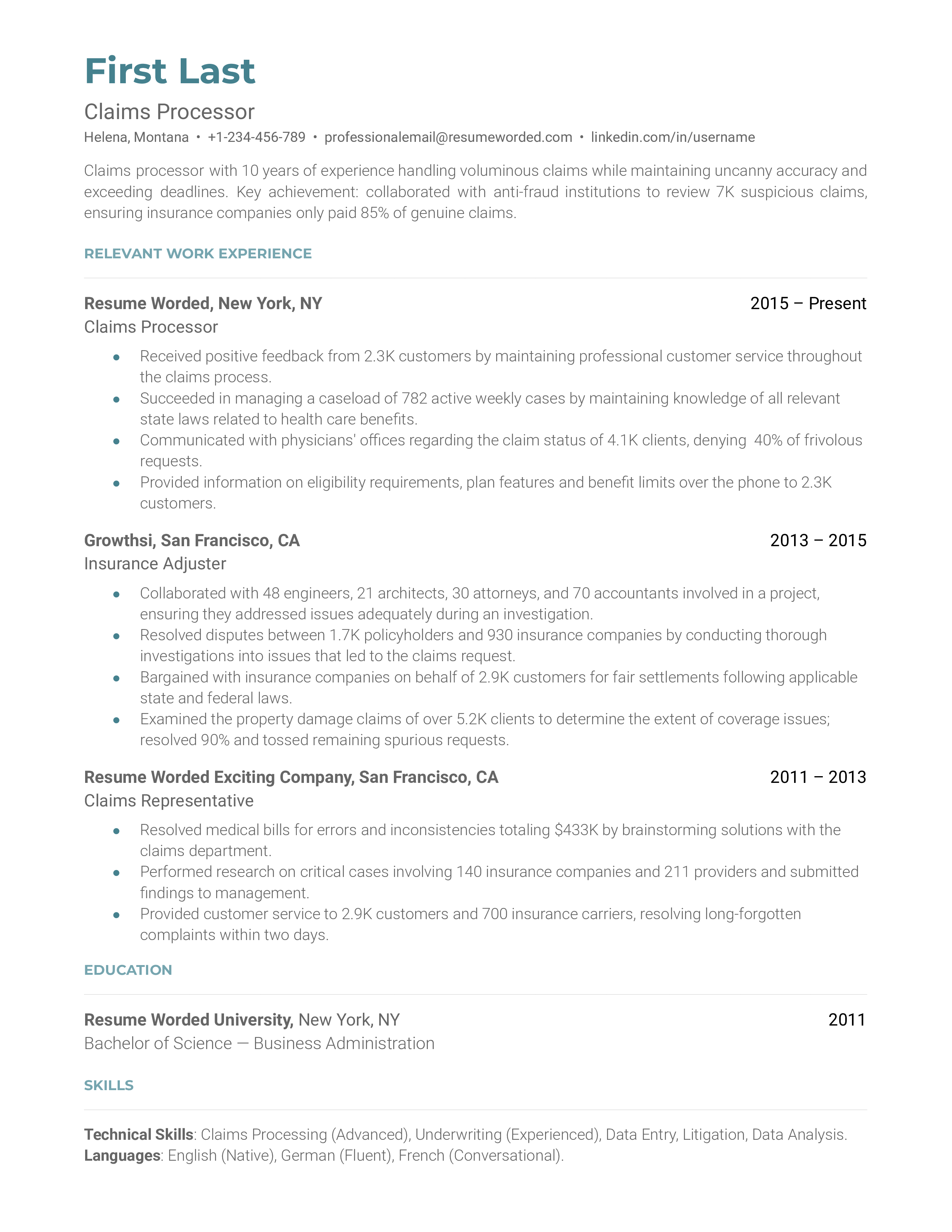

To develop a solid structure for your occupation as an independent insurance adjuster in the insurance market, concentrate on developing a durable adjusting portfolio. Your adjusting profile must display your skills, experience, and expertise in taking care of insurance coverage claims effectively and efficiently. Include details find here of the sorts of claims you have worked with, such as home automobile, damages, or responsibility mishaps, and highlight any specialized understanding you have, like taking care of insurance claims in details markets or areas.

When developing your adjusting profile, take into consideration including any type of pertinent accreditations, licenses, or training you have actually completed. This will certainly demonstrate your dedication to specialist advancement and your reputation as an insurance adjuster. Additionally, consisting of endorsements or references from previous customers or companies can assist confirm your skills and dependability as an independent insurer.

Consistently upgrade your changing portfolio with new experiences and achievements to guarantee it remains present and reflective of your abilities. A well-organized and detailed Recommended Site adjusting portfolio will not only attract prospective clients yet also aid you attract attention in a competitive insurance coverage industry.

Networking and Locating Opportunities

Establishing a solid expert network is necessary for independent adjusters aiming to discover brand-new opportunities and increase their client base in the insurance industry. Networking allows insurers to connect with key sector experts, such as insurance service providers, asserts supervisors, and various other insurance adjusters, which can cause recommendations and new assignments. Attending market occasions, such as conferences and seminars, offers important networking opportunities where insurers can satisfy prospective clients and find out about emerging fads in the insurance area.

Verdict

To conclude, aspiring independent insurance adjusters need to have crucial skills and qualifications, navigate licensing and qualification needs, construct a strong adjusting portfolio, and proactively network to find possibilities in the insurance coverage sector. By comprehending the role, honing necessary abilities, getting appropriate licensing, and constructing a solid portfolio, people can position themselves for success as independent insurance adjusters. Networking is also critical in expanding one's possibilities and developing a successful career in this area.

Independent insurance adjusters play a critical function in the insurance policy sector by investigating insurance claims, examining plan information, examining residential or commercial property damage, and analyzing the extent of insurance coverage.Possessing a diverse set of skills and certifications is essential for individuals aiming to stand out as independent insurance adjusters in the insurance coverage industry.Having gotten the vital skills and qualifications required for success as an independent insurance adjuster in the insurance coverage market, the following important step involves browsing the ins browse around here and outs of licensing and qualification requirements. Networking allows insurance adjusters to attach with key industry specialists, such as insurance policy carriers, declares managers, and various other insurance adjusters, which can lead to references and new jobs.In final thought, aiming independent insurance adjusters must have crucial skills and qualifications, browse licensing and certification requirements, develop a strong adjusting portfolio, and proactively network to discover opportunities in the insurance policy industry.

Report this page